Friends, you must have heard about SWIFT CODE. And if you send or call money from abroad, you must have used it also. But a common man will not know anything about it. Today’s article will give you the answer to each of your questions related to SWIFT CODE. If you still have questions left in your mind about SWIFT CODE, you can contact our blog and ask questions. You can also convey your opinion on the article through the comments box. So guys start now what our today’s article SWIFT CODE is. And how to find your bank’s S.C.

What is swift code?

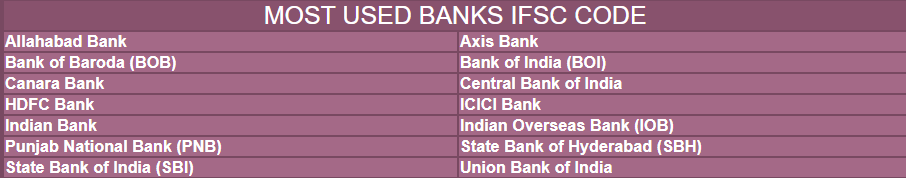

Just as we use IFSC CODE to send money within India, we use SWIFT CODE when we ask or send money from abroad. SWIFT CODE is used to identify a bank and branch in The International Transactions money. Just as we use IFSC CODE when doing household transactions. Some people think ifsc code and SWIFT code are the same. It does not happen. SWIFT CODE and IFSC CODE are completely different from each other. SWIFT CODE is used only in International Banking. While the ifsc code is used in home banking.

What is the Full Form of Swift Code

SWIFT-Society for worldwide interbank financial telecommunication as you will be aware of the name. This code is used in the International Settlements of Banks. BIC (Business Identifier Codes), used in International Settlements of Banks, is also known as SWIFT CODE. SWIFT CODE is also known by other names such as BIC CODE, ISO9362, etc. But all three of them are the same. In banking exams, you are sometimes asked questions called BIC CODE or ISO9362 instead of SWIFT CODE. So here you don’t have to be a fuse at all.

As we’ve already spoken to you. The interbank financial telecommunication code for SWIFT-Society for worldwide is used in International Banking. Whenever you ask or send money from abroad. So S.C only shows which bank of the country you want to send your money to. SWIFT CODE is an 8 to 11 digit code. Including bank name, complete information about the country in which the bank is, the location of the bank, and the bank’s branch information.

Learn! 11 What characters of CHARACTERS do you say?

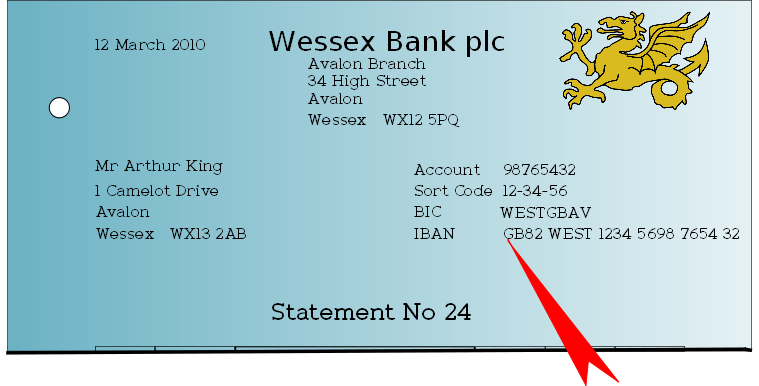

So far you know that a SWIFT CODE can have a total of 8 to 11 CHARACTERS. Now we’re going to tell you how many parts a SWIFT CODE is mainly divided into. And what CHARACTERS represent. Let’s tell you a SWIFT CODE is mainly divided into four parts. Which are the following?

1. BANK CODE(sbi/ icici bank)

2. COUNTRY CODE

3. LOCATION CODE

4. BRANCH CODE

Example – Sbin-in-Bab-496

Bank Code- Sbin

Country Code- In

Location Code- Bab

Branch Code- 496

Bank Code (A-Z) (First Four Characters)

The first 4 digits in the 11 digit code are known as BANK CODE, which can be any letter from A to Z of the English alphabet. Generally, it looks like a short form of the bank name. That is, letters from one to four represent bank CODE. Who tells about the bank. In which bank it is to send money, it shows only these first 4 digits.

COUNTRY CODE (A-Z) ( fifth and sixth characters)

It contains two letters. Swift CODE’s pathway and sixth letters are used for COUNTRY CODE. From which country Bank is located. In which country the bank is, it is revealed through these two letters.

LOCATION CODE ( 0-9 OR A-Z) (seventh and eighth character )

The third part of the swift CODE is called LOCATION. LOCATION CODE consists of 2 letters or digits. The seventh v8th digit or letter of swift CODE is called LOCATION CODE. This shows the location of the Bank in that country. Both these digits are used for bank locations in a country.

BRANCH CODE ( 0-9 OR A-Z) (last four characters )

The fourth and last part of the swift CODE is called BRANCH CODE. It is a 3 digit code consisting of letters or digits.

Let’s tell you earlier SWIFT CODE was only 8 digits. And it represented the bank’s head office. But now normally SWIFT CODE is 11 digits. And its last three digits represent Bank’s Branch.

How to find your Bank’s SWIFT CODE

|

If your Bank Passbook doesn’t have your Bank’s SWIFT CODE. And you don’t even want the branch to know him. So you can know your bank’s SWIFT CODE at home. For this, you have to go to https://www.ifscswiftcodes.com first. On the homepage of the website, you will find a window to know swift CODE.

|

How It Works, Swift Code?

In modern times, if you need to send money abroad, it’s very easy, you have to go to your BANK. And give your Bank some form. Bank sends your money to your person’s account. Even if that person is sitting in the United States across the seven seas from you. If SWIFT CODE were not there, it would not have been so easy. You’ve ever wondered how Bank sends your money to any corner of the world through just one code. Now we’re going to tell you how S.C works.

In fact, BANK and FINANCIAL INSTITUTION send and receive massage in a fast, correct, and secure manner through SWIFT CODE. Information is recorded to receive money in these massages. Recipient BANK deposits money into the account holder’s account based on these instructions.

How many institutions in swift network and how many transactions daily

No of Institute and No of Transaction on Day Under Swift Network

Swift NETWORK has more than 11000 MEMBERS worldwide. Which are spread across 200 countries all over the world? In 2015, an average of 32 million messages was sent daily under the SWIFT NETWORK. Meaning 32 million TRANSACTIONs are made on SWIFT NETWORK every day in different countries around the world. The number was only 2.4 million daily by 1995.

Who uses S.C. (BIC code)

Initially, S.C was designed for TREASURY and associated TRANSACTIONs. But this NETWORK was so SECURE, correct, and FAST thought of using it in BANKING TRANSACTION. And today almost every FINANCIAL INSTITUTION and BANK in the world is using it. And it’s known for its SECURE, correct, and FAST NETWORK all over the world. Today S.C is primarily used in the following types of institutions.

- Banks

- Clearing Houses

- Brokerage Institutes And Trading Houses

- Securities Dealers

- Asset Management Companies

- Depositories

- Exchanges

- Corporate Business Houses

- Treasury Market Participants And Service Providers

- Foreign Exchange And Money Brokers

- Capital And Share Markets

History of S.C

SWIFT NETWORK was founded in the year 1970. The main purpose of introducing this was to create a Fast, Secure, and Correct network for the Financial System at the Global level. In 1973, 239 banks from 15 countries in the world decided to work together to overcome the difficulties faced by cross BORDER TRANSACTION. All these banks together formed a cooperative utility called SWIFT-Society for Worldwide Interbank Financial Telecommunication.

Headquarters

Swift-Society for Worldwide Interbank Financial Telecommunications is headquartered in Belgium.

First Massage Under C.D Network

Even though the swift network was laid in 1970. But it took 7 years to send its first MASSAGE. It was the year 1977. When the first message was sent under SWIFT NETWORK. And today its number of members has crossed 11000. The number was only 239 in 1979. And it was spread across 15 countries of the world. By 1983, the number rose to 1000. And now it had to build its network in 79 countries of the world. By 2009, it had spread to 209 countries, spread almost all over the world. By 2009, the swift network had 9000 members. And by the year 2014, it has more than 11000 members in more than 200 countries in the world. And about 32 million people are exchanged on SWIFT NETWORK every day.

READ THIS ARTICLE ALSO :

- Social Media Influencer Awesome Ways to Side Income. || make money online ||

- What’s app Banking Through Whatsapp Will Change The Way Of Banking

- Start your own business under the central government’s scheme, can get up to Rs 10 lakh help

- 10 Quick Tips For How To Start A Mobile Shop Business Ideas.2020

- How to Create a Flipkart Affiliate Account and Earn Money from Flipkart?

- Farmers can now earn more profits by selling dung to the government,

- Do not be concoff in bank cheques and DDs, know the difference between the two before the transaction

- Gold Price: Gold fell nearly 10% in a month, silver down 10,000 rupees from August high

- How to get money from Facebook? (best secret trick)2020 ALL NSOLL A TO Z